NCBA Becomes First Bank in Kenya to Earn PCI DSS Certification

NCBA https://ke.ncbagroup.com/ has become the first bank in Kenya to achieve the Payment Card Industry Data Security Standard (PCI DSS) Version 4.0.1 certification.

The milestone strengthens its leadership in digital banking and shows its strong commitment to protecting customer data.

The certification covers both NCBA Bank and Loop Cards. It also places the bank on VISA’s global registry.

This achievement comes as the Central Bank of Kenya prepares new guidelines for e-money and digital wallet protection to curb growing fraud cases.

NCBA Becomes First Bank in Kenya to Earn PCI DSS Certification

Strengthening Trust in the Digital Economy

The Communications Authority of Kenya reported more than 400 million attempted cyberattacks last year, most of them targeting the financial sector.

With global cybercrime losses expected to reach USD 10.5 trillion by 2025, NCBA’s certification arrives at a crucial moment for the industry.

“Banking is a business of trust, and we know that risk keeps evolving,” said Isaac Owilla, NCBA Group Director for Technology and Operations.

“This certification strengthens our framework and ensures we remain compliant with global standards. It also helps our digital-first platform grow securely as we expand digital payments and lifestyle services.”

A Culture of Security and Collaboration

The PCI DSS certification followed a detailed audit of NCBA’s systems, policies, and operations. The process confirmed that the bank meets strict international standards for protecting customer data.

This places NCBA among a select group of regional institutions recognized for top-tier security.

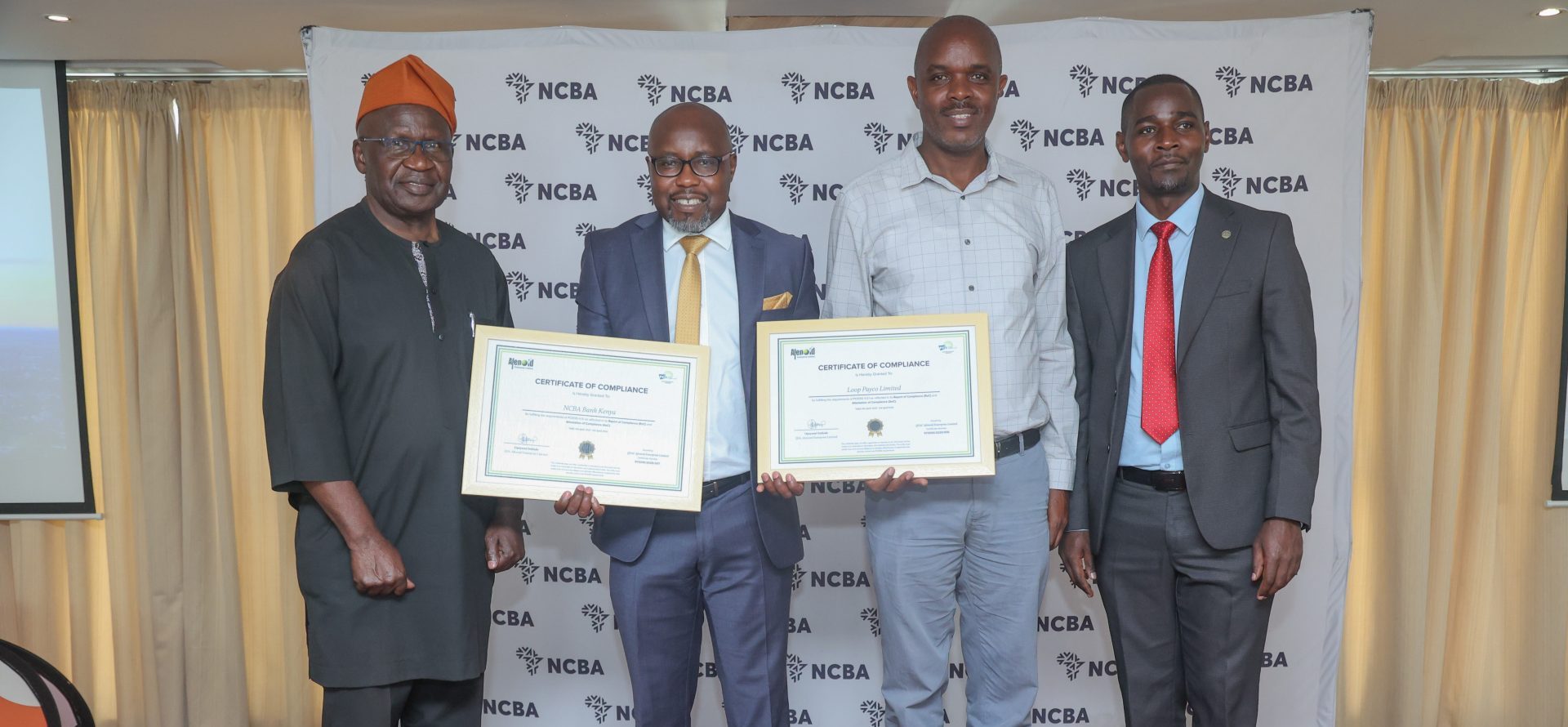

Preston Odera, Country Representative for Afenoid Enterprise Limited, NCBA’s Qualified Assessor Company, praised the bank’s focus on trust and safety. He noted that NCBA has made security part of its culture and continues to set a strong example for the region.

Visa also commended the achievement. “Visa is proud to partner with NCBA in building customer trust through secure systems,” said Basil Kithinji, Visa Director for Risk, East Africa.

“This certification proves NCBA’s dedication to embedding security in every part of its operations.”

Leading Kenya’s Digital Future

With this certification, NCBA strengthens its role in supporting Kenya’s digital economy. The milestone gives customers, regulators, and partners greater confidence in the bank’s systems.

It also positions NCBA as a leader in secure, innovative, and trusted banking across East Africa.

Comments