Mi Vida Homes Announces Management-Led Buyout from Actis

Mi Vida Homes Limited has signed a share purchase agreement for a management-led buyout from Actis, the global sustainable infrastructure investor. The deal, pending regulatory approval, marks a major milestone in the company’s growth journey.

A New Chapter for Mi Vida

Established in 2018 as a green and affordable housing developer, Mi Vida has built a strong reputation for delivering high-quality, sustainable homes. Though the transaction’s value remains undisclosed, it reflects investor confidence in the company’s maturity and readiness for participation in local capital markets.

Mi Vida CEO Samuel Kariuki called the buyout a defining moment for the local housing industry.

“This is the first transaction of its kind involving a residential development platform in our market,” he said. “It proves that institutional home builders can thrive in Africa while maintaining strong ESG and financial standards.”

Mi Vida Homes Announces Management-Led Buyout from Actis

He added that Mi Vida’s goal has always been to deliver modern, sustainable homes that meet local needs.

“With a solid balance sheet, diverse capital base, and strong project pipeline, we are ready to scale further,” he noted. “We appreciate Actis for helping us build a sustainable, investment-grade platform anchored on sound governance.”

Actis Reflects on the Partnership

Actis Partner Louis Deppe said the deal demonstrates the potential for long-term capital formation in African real estate.

“It confirms the strength of a model where global investors incubate, institutionalize, and later transition platforms to local ownership,” he explained. “Our work with Mi Vida shows that Africa’s residential sector is both scalable and investable, supported by strong demand and deepening capital markets.”

Deppe noted that Actis’ Africa Real Estate arm has been at the forefront of building sustainable property platforms. He said such models prove that disciplined, well-governed real estate businesses can grow and thrive across the continent.

A Testament to Sustainable Growth

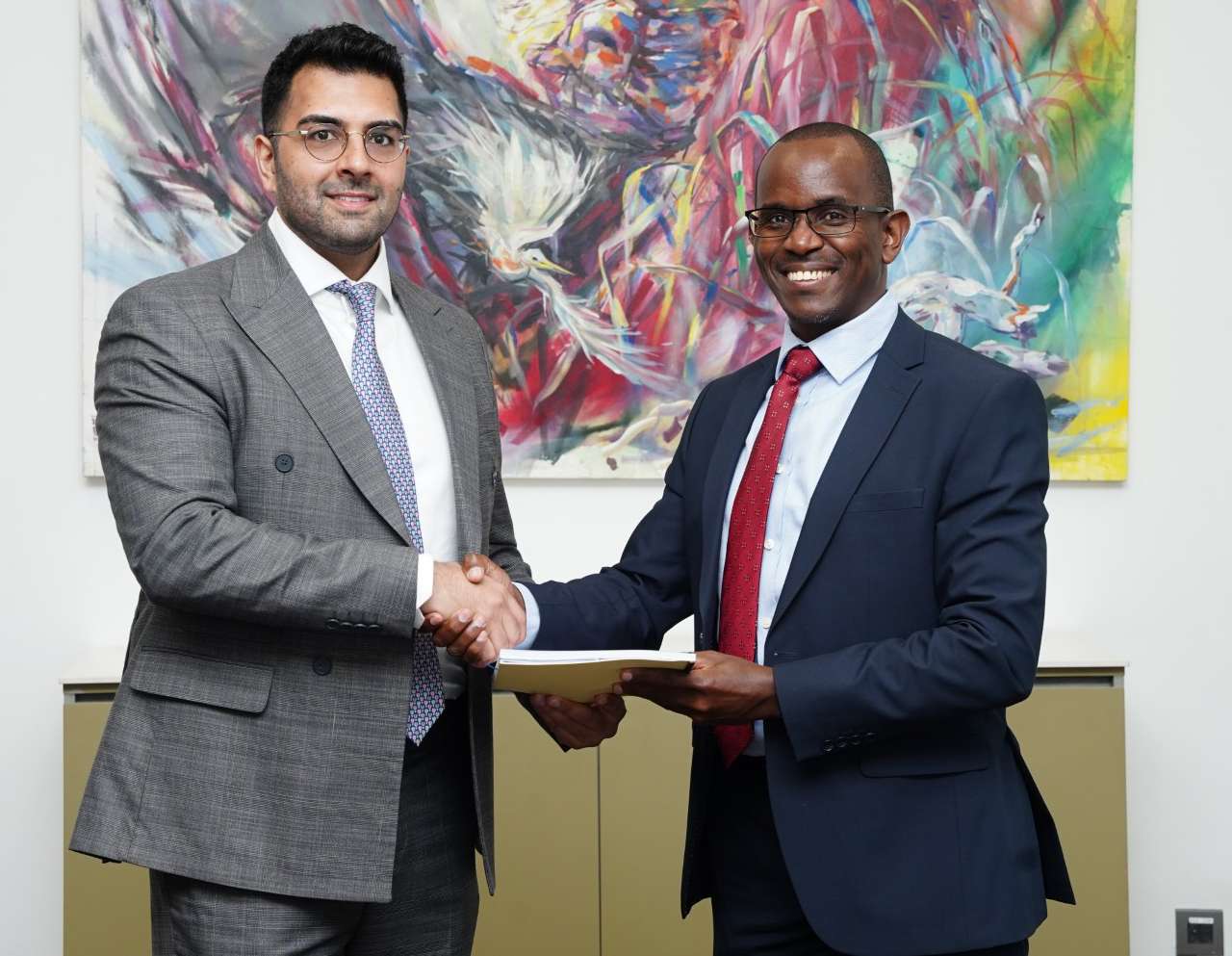

Ravi Rughani, Principal at Actis, described the partnership as a rewarding journey.

“This transaction validates the vision we set out in 2018, to build a strong, institutional-grade housing platform that meets local demand while delivering value to investors,” he said.

He praised Mi Vida’s disciplined execution and focus on community impact.

“The transition to a management-led consortium highlights the team’s strength and the resilience of the business,” Rughani said. “It aligns perfectly with Actis’ philosophy of building scalable, sustainable companies that create long-term value while addressing local needs.”

Looking Ahead

With its management now steering the company, Mi Vida enters a new phase of growth. Its strong governance, expanding capital base, and commitment to sustainability position it to play a greater role in shaping the future of affordable and mid-market housing across Africa.

Comments